Evaluating an institution’s existing academic program portfolio or potential new programs generates four important questions related to markets.

What is the student demand?

- To what extent is your institution competing with its peers for these students?

- What are the employment prospects for students completing these programs?

- Is the program offered at the right degree level?

All of these questions can be answered with appropriate market data and evaluation.

Define Your Relevant Market

An important initial step is to clarify the geographic scope of your market. This step will guide the consideration of your market potential.

At Concordia University, we mapped market data down to the census tract level. This ensured that our data aligns precisely with U.S. Census data on population, ethnicity, income, and other factors. Our stakeholders discussed whether to include or exclude particular markets. We clarified the geographic scope for program analysis.

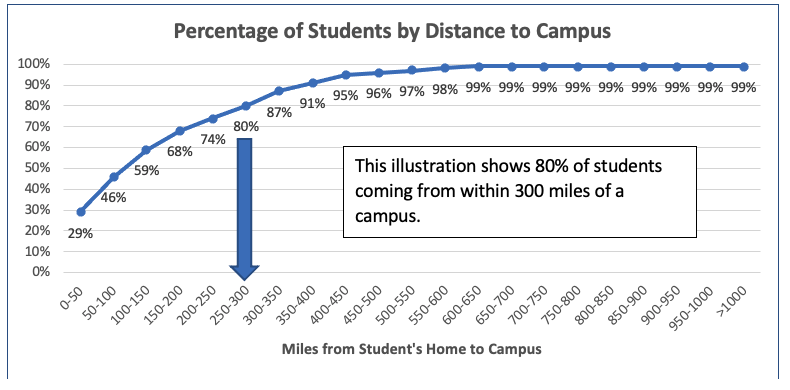

We asked ourselves, “From what areas do we draw most of our students?” We discovered that 80% of our students come from within a 300-mile radius of our Mequon, WI campus and from within a 150-mile radius of our Ann Arbor, MI campus. These are our two primary markets. Schools may elect to adjust the size of this radius by changing the percentage of students within each distance to campus.

Below is an illustration of what this might look like for a college campus. In certain circumstances, it’s also appropriate to consider secondary or national markets. For example, when we evaluate an online program, we usually look at the national market in addition to the local market.

Prioritize the Market Factors

Another key step in this process is to assess the importance of market factors relative to each other. Conduct this assessment with your institution’s academic leaders soliciting their input and striving for consensus. Ask them to what extent your academic program evaluation should emphasize student demand versus competitive intensity and employment. My institution’s leadership team brought forward differing individual viewpoints, as some leaders emphasized student demand while others placed a greater premium on employment. However, after much debate and careful consideration, they reached a consensus and assigned percentage weights to each of the three categories. While these discussions may sound somewhat conceptual in nature, they are key for establishing buy-in for the process. If possible, develop a scoring rubric that will correctly identify programs that fit your goals and strategies.

Compile the Market Data

Now that you’ve defined your relevant market and prioritized market factors, you can begin to compile the market data for analysis. Be aware that there are a myriad of data points available. For example, there are currently over 1,400 academic programs from which to choose, based on the Classification of Instructional Programs (CIP) codes. A number of these codes/programs are already included in your institution’s program portfolio, while the rest may be included for potential consideration. If you decide to track only 5 data points for each of these programs, then it would require a review of over 7,000 data points! What’s more, these data points are constantly changing. Using a data service will allow you to spend less time on compiling the data and more time on conducting the analysis.

As I mentioned in a previous blog post: Establishing Data Governance in Academic Program Evaluation, a market analysis is the first step in my institution’s framework for approval of new academic programs. This step adds efficiency since an assessment of a weak market would quickly halt the program evaluation process before expending unnecessary time and resources.

In my next blog post, I’ll provide a case study in which a new academic program proposal was proposed at my institution. I’ll review the market data we used to assess the strength of the market for this program.