The face of US university campuses is subtly changing. This academic year, American institutions welcomed 17% fewer new international students, marking a significant decline that extends beyond just the cultural atmosphere of campus life. It points to deeper trends impacting both the diversity and the financial stability of higher education in the US.

New Data Reveals the Widening Gap in International Student Recruitment

According to new Institute of International Education (IIE) data, which surveyed 825 schools, the overall picture of international enrollment is complex:

- Total Enrollment: The number of international students nationwide decreased by 1% overall.

- Undergraduate Stability: Enrollment at the undergraduate level increased by 2%, indicating continued strong interest in four-year degree programs.

- Graduate Concern: The most substantial drop occurred in graduate programs, which experienced a 12% decline in enrollment. This is a critical area, as graduate students often form the backbone of university research and teaching assistant roles.

Digging Deeper: Shifting Interest in International Student Demand

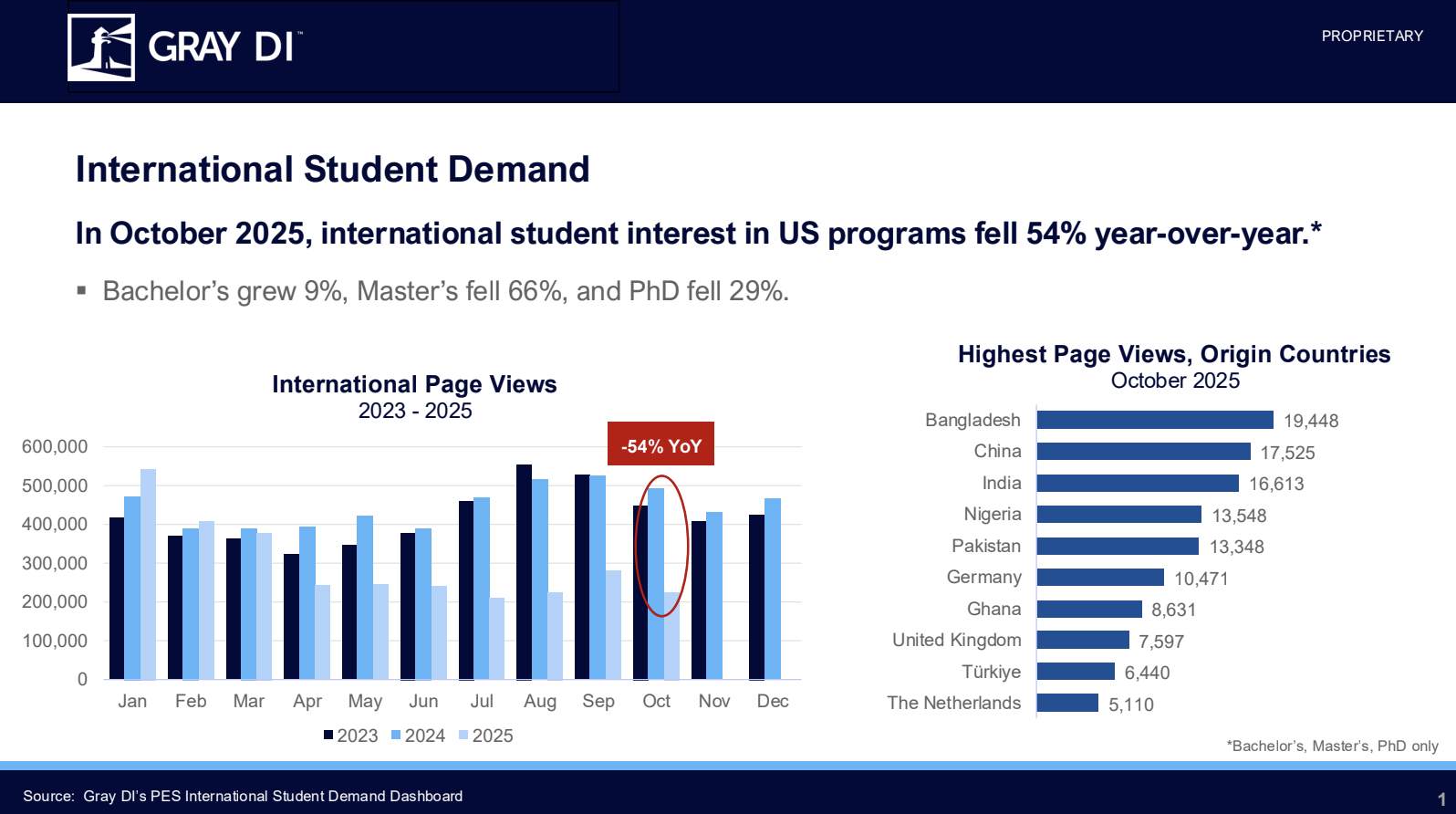

Our internal data paints an even more dramatic picture of the shifting interest in US programs.

Sharp Drop in Interest: In October 2025, international student interest in US programs plummeted by 54% year-over-year. This is a significant decline in preliminary engagement.

The Divide in College Program Demand for International Students

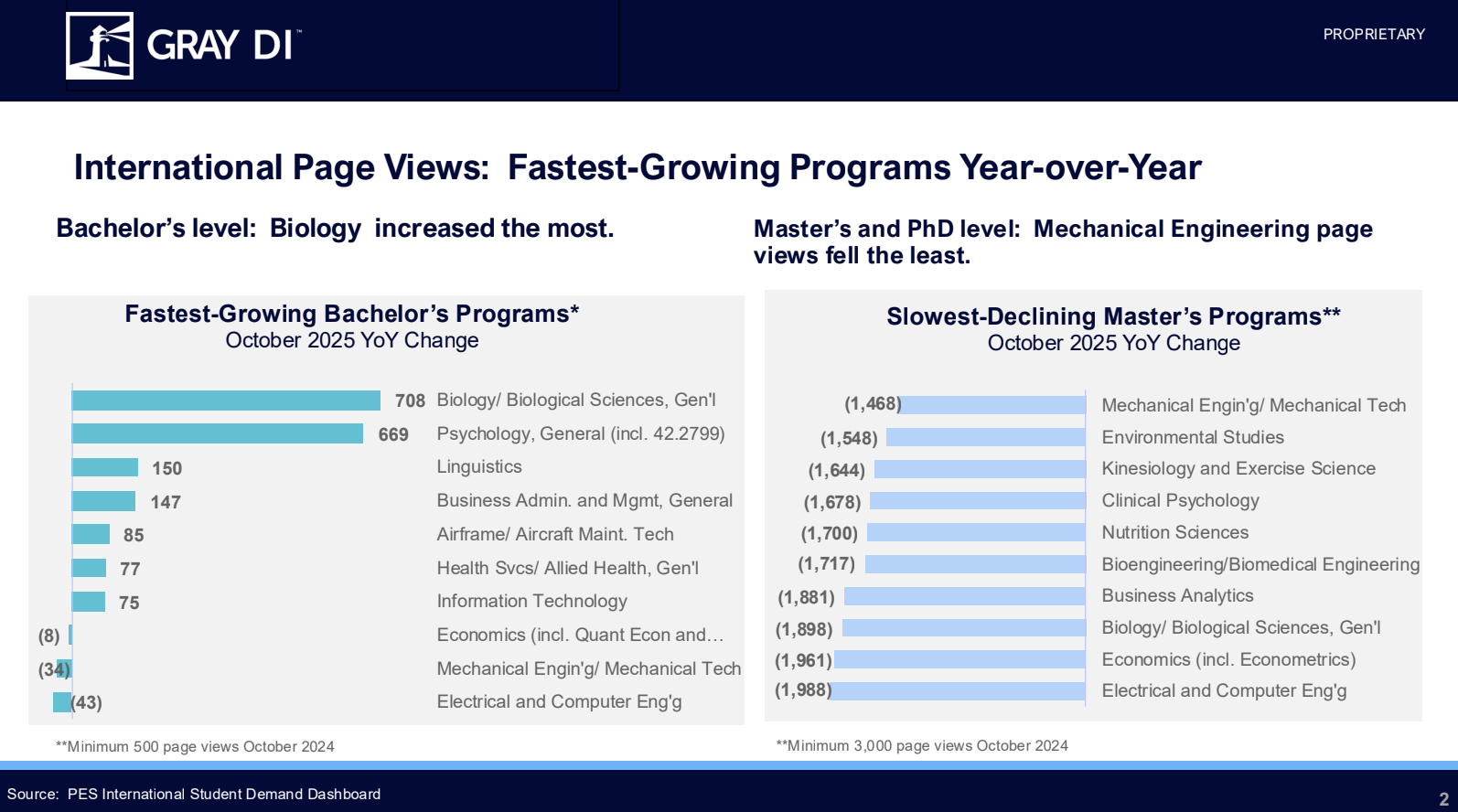

Looking at international page views for programs, we see the divide between degree levels widening:

- Bachelors: This level showed some year-over-year growth. Biology was the strongest performer, gaining 708 views.

- Masters: These programs suffered significant losses. Even the program with the slowest rate of decline, Mechanical Engineering, still lost 1,468 views, underscoring the severity of the drop in graduate-level interest.

Source: Gray DI’s PES International Student Demand Dashboard

The Imperative for Recruitment: Perspective and Pay

Despite the overall decline in new students, US universities are not wavering in their commitment to global outreach. The vast majority of institutions see international recruitment as a crucial strategic imperative. Getting back to the survey, here are some insights from higher education.

The Value of Global Perspective (81%)

The primary motivation for continued recruitment is academic and pedagogical. Eighty-one percent of surveyed schools emphasized the value of the unique perspectives that international students bring. Their presence enriches classroom dynamics, challenges domestic students to think globally, and prepares all graduates for an interconnected professional world. This commitment to diversity and global competence remains paramount to maintaining a world-class academic environment.

The Financial Contribution (60%)

In an era of rising operating costs and complex funding models, the financial stability provided by international students is essential. Since these students typically pay the full tuition rate, 60 percent of schools explicitly noted their critical financial contributions. They represent a reliable, non-federally subsidized revenue stream that supports academic programs, research, and campus infrastructure.

Are International Students a Strategic Priority?

The message from US higher education leadership is clear: this is a vital area for investment. Eighty-four percent of institutions consider international recruitment a major priority. Reversing the recent declines, particularly at the graduate level, will require concerted strategic efforts in areas such as targeted outreach to programs like Biology and careful analysis of the factors driving the significant decline in interest across the board.

The challenge for universities now is to actively demonstrate their value and commitment to prospective students abroad, ensuring that the US remains a premier destination for global talent and educational exchange.

Source: Based on data from the Institute of International Education (IIE) survey, as reported by Axios, and proprietary Gray DI data (October 2025).